MQL5 Free EA – Verification by backtesting 1 "Dark Venus MT5"

In the “Verification by backtesting" series, we verify the performance of free EAs registered in the MQL5 community from the backtesting results. We hope it will help you choose EA.

* Membership registration (free) is required to download EAs and indicators from the MQL5 community, so let’s create an account by referring to this article!

The first is “Dark Venus MT5“.

About “Dark Venus MT5“

Quote from the official MQL5 page (translation)

caution

- Downloading robots requires optimization experience.

recommendation

- The recommended time frame varies depending on the setting, but basically “M5", “M15", and all time frames can be used depending on the setting.

- The EA supports EURUSD, GBPUSD, AUDUSD and USDCAD. Other currency pairs are also supported depending on the settings.

- ECN brokers are recommended.

- A low latency VPS is recommended.

- The recommended leverage and the recommended amount of funds depend on the settings.

- Click here for the user manual and some example configuration files

Dark Venus MT5 is a high-frequency trading EA. Martingale type EAs generally have a high probability of stopping out when the amount of funds is low. When you encounter a drawdown depends on “luck", so it is possible to operate it for only 2 or 3 weeks in a small gambling manner, but if it is safe operation, it is recommended to operate with a amount of funds or settings that can withstand a long time.

Trading “Dark Venus MT5"

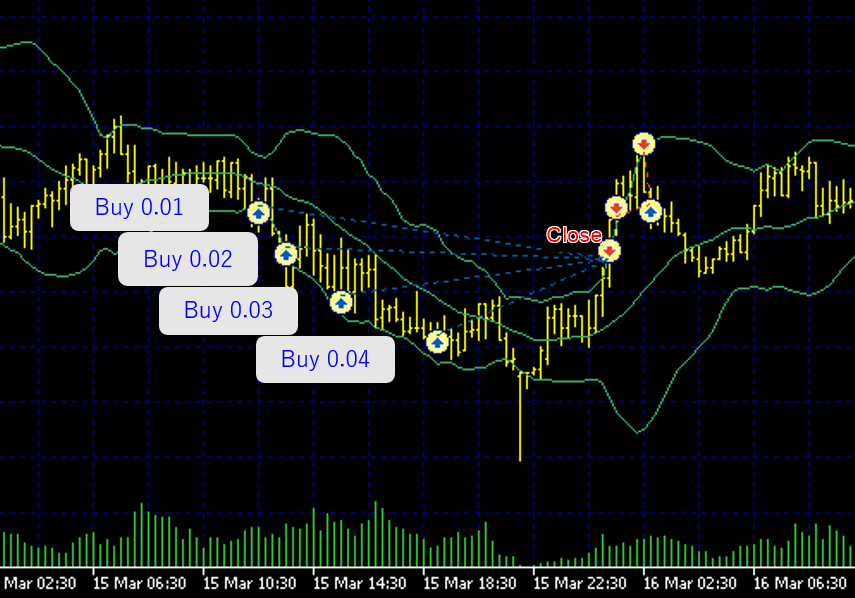

- This EA is a nampin martingale type, it stacks positions along the Bollinger bands and closes when the rate returns and the total profit is generated. The parameters allow you to manage the entry of positions in the grid, as well as the duration of the Bollinger Bands and the sigma value.

- As for the number of lots, the initial lot is 0.01 by default, then 0.02 ⇒ 0.03 ⇒ 0.04 ⇒ 0.05 ⇒ … … If you change the initial lot to 0.02, the number of lots thereafter will be 0.04 ⇒ 0.06 ⇒ 0.08 ⇒ 0.10 ⇒ … It doubles as in.

Screening of supported currency pairs/timeframes

Screening under recommended conditions

- Selection criteria: In my case, the selection (optimization) of martingale type EAs focuses on the following three points.

- Small downdown (unrealized loss) (no stop-out for a long period of time)

- Sufficient number of trades

- The size of the drawdown is balanced with the revenue

First, we conducted a backtest on the currency pair and time frame recommended by the developer. The test was conducted on the NOZAX Zero Account (ECN) with an initial balance of $10,000, and the period was January 1, 2008 ~ November 30, 2022 to see the long-term results. Note that the EA parameters remain at their default settings.

- COMPARATIVE SYMBOLS: 4 CURRENCY PAIRS – EURUSD#, GBPUSD#, AUDUSD#, USDCAD #

* MT5 has a function to backtest and compare all stocks displayed in the Market Watch window at once, which is effective for screening compatible currency pairs.

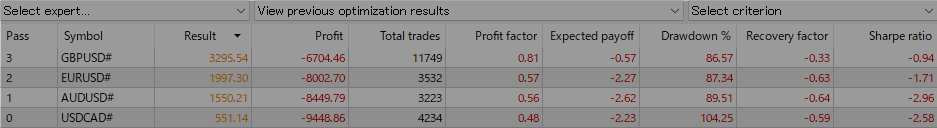

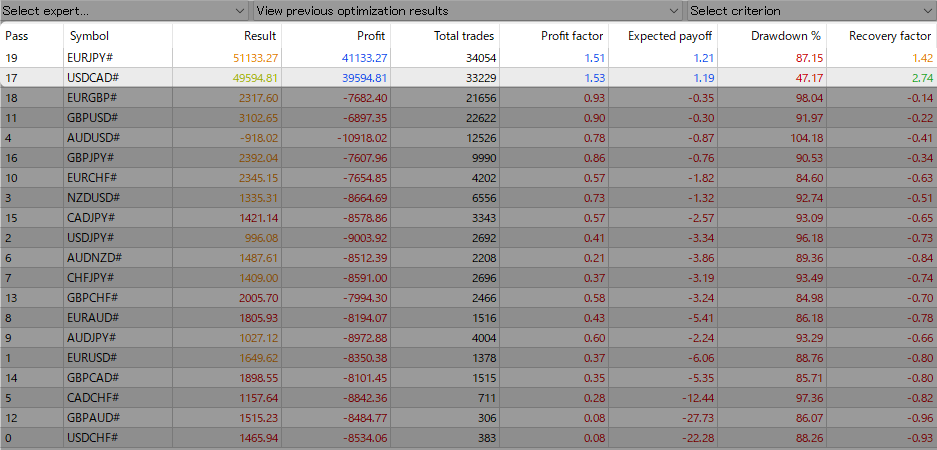

M5

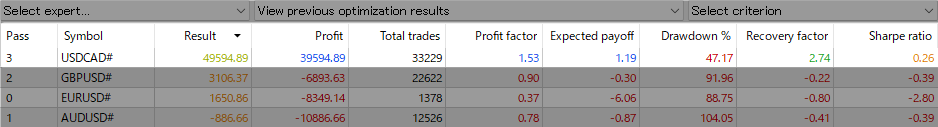

M15

Based on these test results, only USDCAD M15 remained as a candidate.

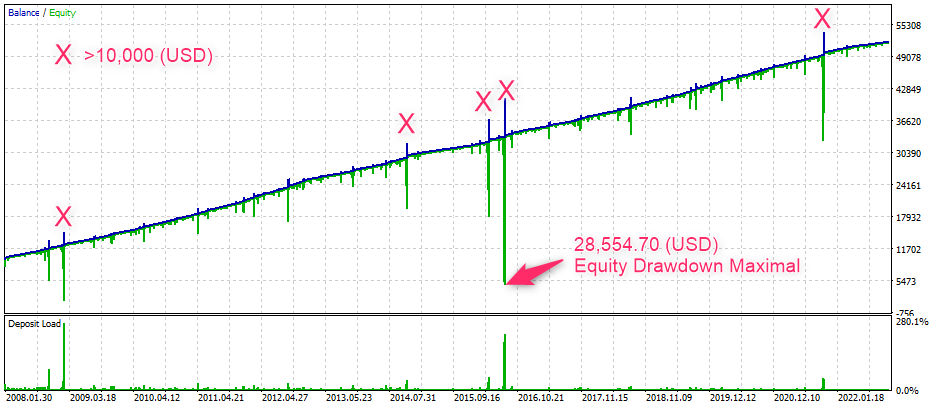

USDCAD M15 Backtesting

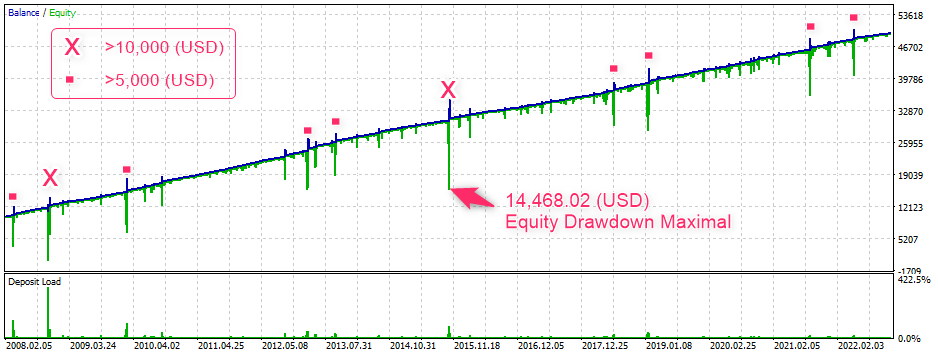

Since there are cases where the stop out is due to the difference in the start time, we conducted a backtest of USDCAD M15 for about 15 years from 2008 to 2022 and examined the drawdown (Equity Drawdowon) while holding positions.

USDCAD# M15

If you check the asset curve…

Initial balance of $10,000 (period January 1, 2008 ~ November 30, 2022)

I think it is a very good profit and loss curve of Nanping Martingale. However, it was revealed that the Equity Drawdown exceeded $10,000 twice during the testing period, and exceeded $5,000 on 10 occasions. From this, it can be said that the reason why the USDCAD M15 did not encounter a stop out in the test from 2008 was simply because the test start time was good. Of course, if you have ample funds, there is no problem.

Screening of currency pairs (time frames) other than recommended conditions

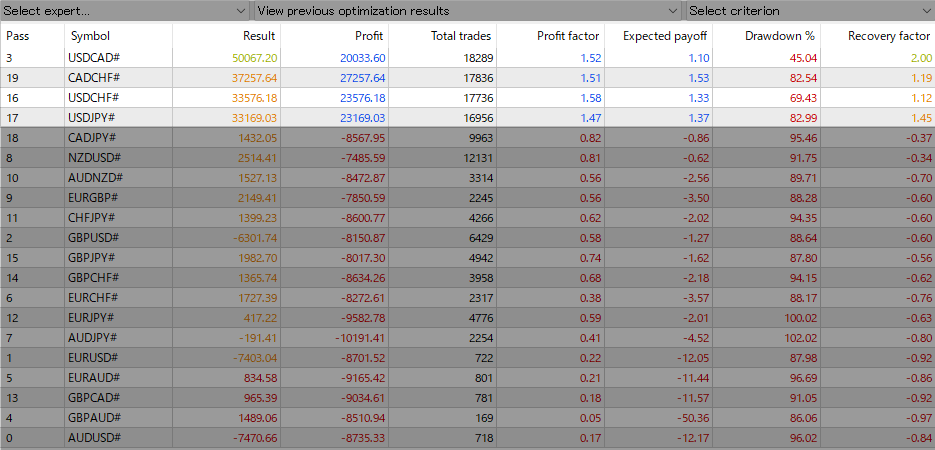

Subsequently, a similar test was conducted with the addition of 16 currency pairs to explore currency pairs that could be used outside of the recommended currency pairs. The test conditions are the same: NOZAX Zero Account (ECN), initial balance of 10,000 USD, period January 1, 2008 ~ November 30, 2022, EA parameters remain at their default settings.

- Comparative Stocks: 20 Currency Pairs – AUDJPY#, AUDNZD#, AUDUSD#, CADJPY#, CADCHF#, CHFJPY#, EURAUD#, EURCHF#, EURGBP#, EURJPY#, EURUSD#, GBPAUD#, GBPCAD#, GBPCHF#, GBPJPY#, GBPUSD#, NZDUSD#, USDCAD#, USDCHF#, USDJPY #

M15

M30

As a result of the screening, EURJPY for M15 and USDCAD, CADCHF, USDCHF and USDJPY for M30 remained as candidates other than the recommended conditions. We conducted individual backtests to see how big the Equity Drawdowon may be encountered when trading these currency pairs.

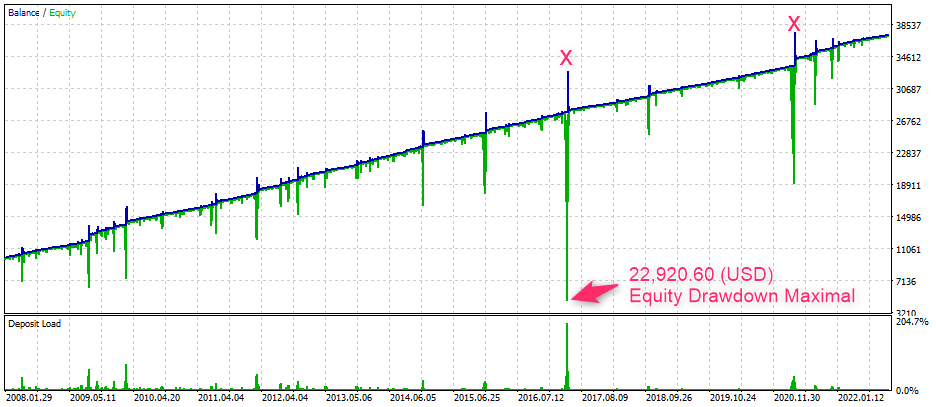

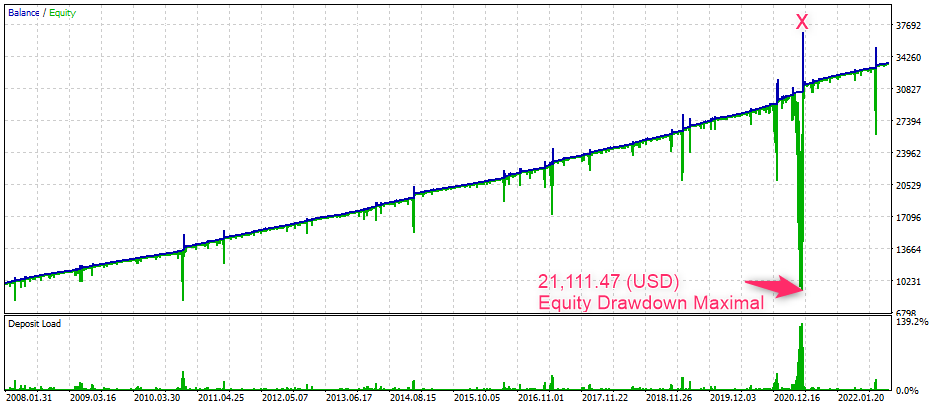

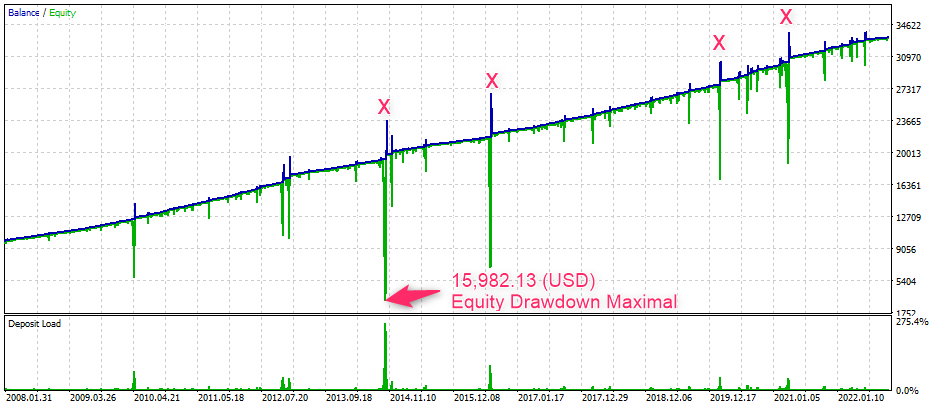

Backtesting of selected currency pairs (timeframes)

- Account: NZX Zero (ECN) (NOZAX)

- Initial Balance: $10,000

- Parameters: Initial Setup

- Period: January 1, 2008 ~ November 30, 2022

EURJPY# M15

USDCAD# M30

CADCHF# M30

USDCHF# M30

USDJPY# M30

Unfortunately, both tests resulted in unrealized losses of more than $10,000. It’s just that the start of testing of these was good. However, as for the USDCHF M30, it seems to have stabilized quite a bit, maintaining a low drawdown for more than 13 years since the start of testing, and it seems that it has suffered a large drawdown for the first time in 2021.

Martingale type EA tends to be stable, although the number of transactions decreases and profits decrease as the time axis increases. “Dark Venus MT5" seems to be no exception. In order to minimize the risk of a large drawdown, such as the one observed in the USDCHF M30 in 2021, it is also a good idea to trade slowly on the one-hour timeframe.

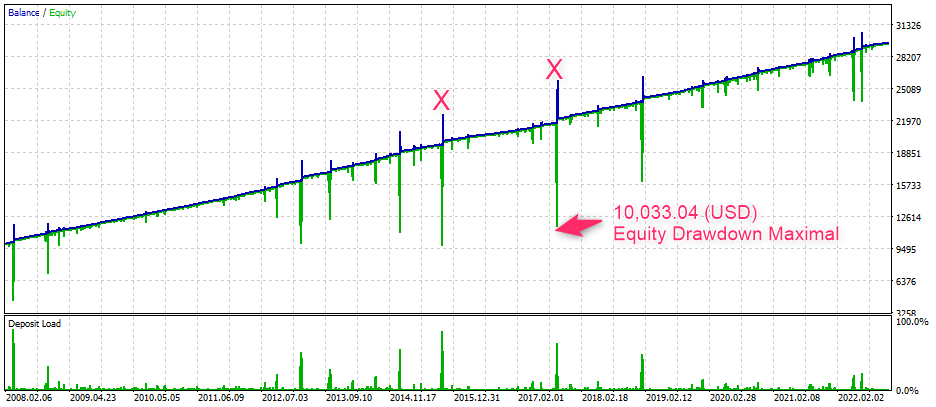

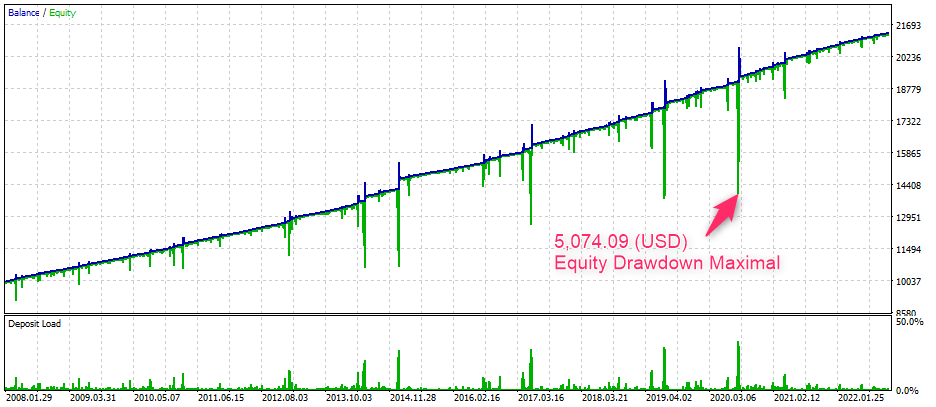

Backtesting at USDCHF H1

As a reference, we will introduce the test result (profit and loss curve) of USDCHF, which was estimated to be stable on the 30-minute timeframe, when it is operated on a 1-hour timeframe.

USDCHF H1

Initial balance of $10,000 (period January 1, 2008 ~ November 30, 2022)

- By running on the one-hour timeframe, it was fairly stable, and the margin drawdown during the testing period did not exceed $10,000.

However, again, there is a good chance that something will happen to the nanpin martingale type EA, so don’t be careful! If you want to operate a martingale type EA, you want to start operating with at least twice the maximum margin drawdown (Equity Drawdown Maximal).

On the official website, an example of setting parameters (SET File) is also available. However, if the broker (server) changes, the performance will change significantly, so I think it is better to optimize

it according to your environment instead of using the “provided settings" as it is. In MT5, historical data is provided by the broker, and backtesting is much easier and more accurate than MT4, so please give it a try.

The 5-minute and 15-minute operating of “Dark Venus MT5" is attractive because of the large number of trades and high profit margin, but if you are unlucky, it is a risky setting that will fall into drawdown / stop out immediately after the start of operation.

Only if you are confident that “I will never face a drawdown!“, why not try it in a short-term game? (Please do so at your own risk.) If you get tired, please prepare enough funds to make an additional deposit. )